The oversight layer for custody, tokenization, insurance, lending, and supply-chain settlement.

Sterling Strategic is the governance and orchestration layer that connects disconnected systems —

custody, underwriting, lending, logistics, and ERP data — into auditable workflows. Powered by StratChain™,

our settlement and verification infrastructure for real-world assets, title control, collateral delivery, and financial execution.

The next wave of infrastructure won’t be optional — it will be required.

HOW WE SERVE

STERLING STRATEGIC — OVERSIGHT LAYER

Rules • Routing • Compliance • Enforcement

Approve • Deny • Escalate • Verify

CUSTODY & TOKENIZATION

Coinbase

Fireblocks

BitGo

Anchorage

INSURANCE & RISK

Lloyd’s

Aon

Munich RE

Allianz

LENDING & CAPITAL

Apollo

Silvergate

Railsbank

SUPPLY CHAIN

Maersk

Evergreen

FedEx

ERP Backbone

REAL-WORLD EXECUTION

Assets • Inventory • Payments • Ports • Verification

Get Started — Retail / Individual

Begin your intake to explore compliant, structured access to Sterling Strategic services.

Next Steps — Small & Mid-Size Business

Complete your intake to evaluate capital, risk, and settlement pathways.

Enterprise Engagement

Enterprise engagements begin with a strategic consultation.

Digital Settlement Services

Initiate your digital settlement intake or speak with our team.

StratChain Advisory Access

StratChain services are consultative and initiated by direct discussion.

Lending Capital Partners

Submit partner intake information to initiate review.

Insurance Partners

Begin insurance partner onboarding through the intake form.

STERLING STRATEGIC — OVERSIGHT LAYER

Rules • Routing • Compliance • Enforcement

Approve • Deny • Escalate • Verify

CUSTODY & TOKENIZATION

Coinbase

Fireblocks

BitGo

Anchorage

INSURANCE & RISK

Lloyd’s

Aon

Munich RE

Allianz

LENDING & CAPITAL

Apollo

Silvergate

Railsbank

SUPPLY CHAIN

Maersk

Evergreen

FedEx

ERP Backbone

REAL-WORLD EXECUTION

Assets • Inventory • Payments • Ports • Verification

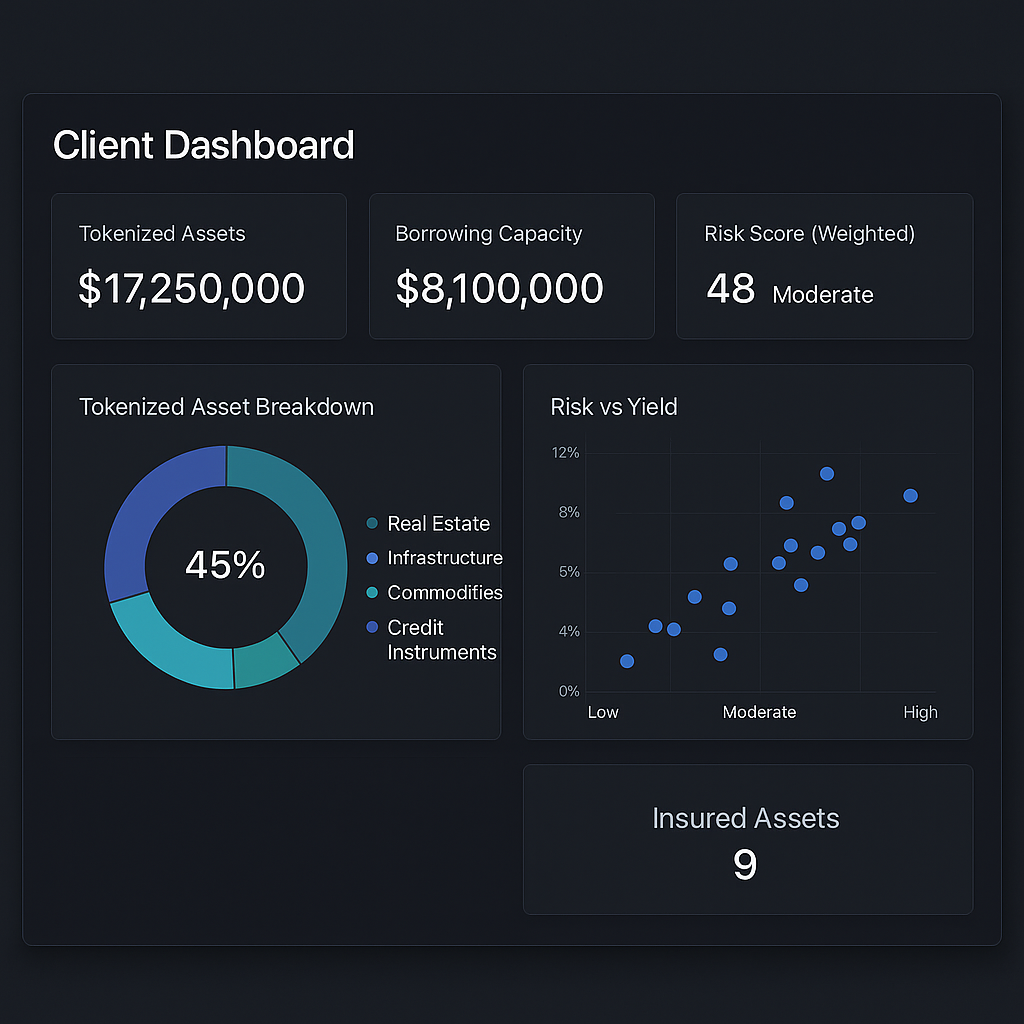

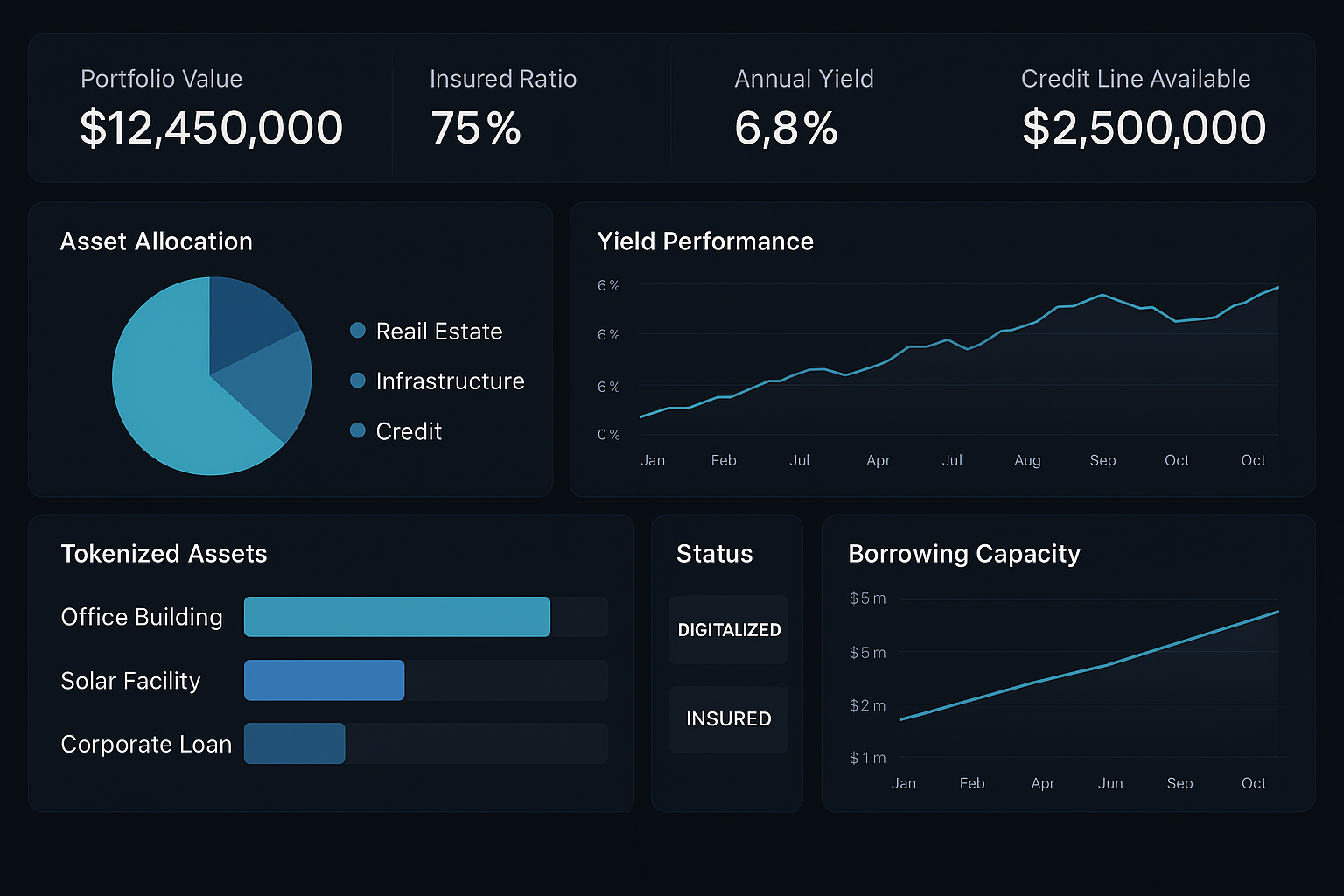

Dashboard Intelligence

A unified rules engine powering every product tier.

Dynamic rule sets trigger based on permissions, collateral, and compliance thresholds.

Live status, alerts, routing & controls

Thresholds, exposure & scenario flags

Yield paths, constraints & logic